Now is an exciting time for all of us engaged in the foundation’s Economic Mobility and Opportunity Strategy because it’s expanding with additional investment resources over the next four years and a renewed commitment to helping our focus population achieve economic security.

That focus population includes the 47 million people in the U.S. who often face some of the highest barriers to economic opportunity and long-term financial stability – those earning annual incomes less than $27,180 individually, or $55,500 for a family of four and who often find themselves in what are considered “low-wage” jobs.

Nearly 60% of workers earning low wages are employed by small and medium-sized businesses – those with fewer than 100 employees, including 35% of workers at micro-businesses with fewer than 10 employees. In addition, the burdens of low-wage work are not distributed equitably, with women and workers of color considerably more likely to occupy low-wage jobs.

Stagnant wages, low job quality, and varying access to benefits create roadblocks to economic security for these workers, and the pandemic’s rippling effect on the U.S. economy coupled with inflation's effect on the cost of everyday expenses such as food, clothes, and gas, make those roadblocks even harder to traverse.

We believe that everyone should have the opportunity to climb the economic ladder, achieve long-term economic security, have agency over their lives, and live with dignity. That’s why we’re working to help our country’s economic systems perform better for the people who need them to work better.

I’m passionate about this work because one of the things we’re doing is partnering across sectors to improve job quality for workers at small and medium-sized businesses. Job quality isn’t just about income; according to research, workers also care deeply about stable and predictable schedules, training and development, job satisfaction, access to basic benefits, and performance incentives.

Although most small and medium-sized business owners recognize the value of their employees, those owners often need information, examples of best practices, actionable resources, and more money to improve job quality in ways that also strengthen the profitability of their businesses and help retain employees.

Providing that assistance takes collaboration and that’s exactly what’s happening through our efforts with Aspen Institute Economic Opportunities Program (EOP). We’re working together on a new initiative called Shared Success: Scaling Financial Intermediary Strategies to Advance Job Quality, Equity, and Small Business Prosperity.

What’s interesting here is the inclusion of financial intermediaries – in this case community development financial institutions (CDFIs), which are lenders with a mission to create economic opportunity for individuals and small businesses, quality affordable housing, and essential community services, especially in rural, urban, Native-American, and other communities. It’s estimated that there are over 1,300 CDFIs nationwide with at least one in each state. Because of their existing and trusted relationships with small and medium-sized businesses in their communities, CDFIs can reach and support those businesses with education, training, financing, and advice on ways to improve job quality.

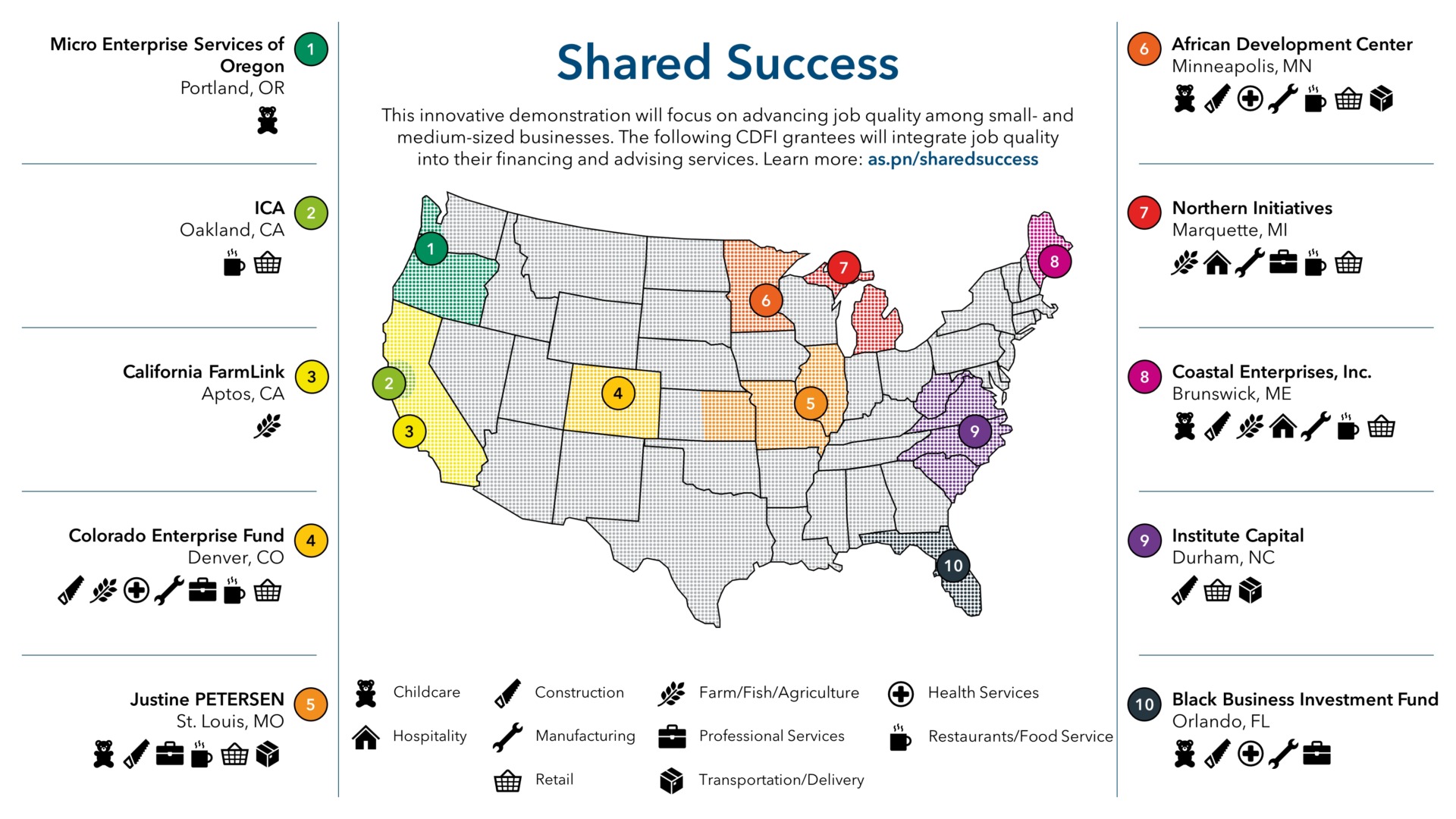

EOP has selected 10 CDFIs around the country as the first step in our four-year pilot project to better understand what resources, technical assistance, and incentives small and medium-sized businesses need to improve job quality while remaining profitable:

- African Development Center (MN)

- Black Business Investment Fund (FL)

- California FarmLink

- Coastal Enterprises, Inc. (Maine)

- Colorado Enterprise Fund

- ICA Fund (CA)

- Institute Capital (NC, SC, VA, WV, DC)

- Justine PETERSEN (MO, IL, KS)

- Micro Enterprise Services of Oregon (OR, WA)

- Northern Initiatives (MI)

These 10 CDFIs will incorporate job quality-related services into their existing operating and financial models and incentivize ways for small and medium-sized businesses to improve worker compensation, employee satisfaction, opportunities for advancement, benefits, and other workforce issues.

As we launch the first year of this project, our hope is that CDFIs will play a critical role in identifying ways to scale job quality as a key driver in improving economic outcomes for workers earning low wages.

Joining us in this effort are U.S. Bancorp Community Development Corporation, which is providing loan capital to small and medium-sized businesses that pilot job quality improvements, and Pacific Community Ventures, a CDFI that has taken a leadership role in integrating job quality into its work with small businesses and will provide resources and support to other CDFIs engaged in this demonstration.

Our long-term goal for this project is to raise the floor for workers across the country’s small business ecosystem and demonstrate that those business owners can improve job quality in ways that strengthen their businesses and increase economic opportunities for their workers. We look forward to sharing the learnings from this partnership with other financial intermediaries and community stakeholders.

By bringing together partners across sectors and working collaboratively on shared goals, we hope to improve our economic systems, increase opportunities for more people, and create a more inclusive economy that leads to equitable outcomes for everyone.